Difference between revisions of "Customer segmentation techniques"

(→Customer segmentation in SimProcess) |

|||

| (26 intermediate revisions by the same user not shown) | |||

| Line 7: | Line 7: | ||

=Customer segmentation in general= | =Customer segmentation in general= | ||

| − | What is customer segmentation in general? It is a sort of practice which divides customers in smaller groups based on multiple characteristics and gives the business a better understanding of its customers, which has a great value in B2C relationship. Some of the other benefits could be identification of least profitable customer group, improvement of customer service, data for making marketing decisions (which group to target) or avoiding unprofitable markets. The main goal of this whole process should be to maximize the value of each single customer. There could be other goals of customer segmentation, however it rather depends on the particular business and its preferences. Examples of common segmentation objectives include development of new product, differentiated customer servicing or targeting prospects with the highest profit potential. | + | What is customer segmentation in general? It is a sort of practice which divides customers in smaller groups based on multiple characteristics and gives the business a better understanding of its customers, which has a great value in B2C relationship. Some of the other benefits could be identification of least profitable customer group, improvement of customer service, data for making marketing decisions (which group to target) or avoiding unprofitable markets. The main goal of this whole process should be to maximize the value of each single customer. There could be other goals of customer segmentation, however it rather depends on the particular business and its preferences. Examples of common segmentation objectives include development of new product, differentiated customer servicing or targeting prospects with the highest profit potential. <ref> Customer segmentation definition [online]. [cit. 2016-01-24]. Available at: http://searchsalesforce.techtarget.com/definition/customer-segmentation </ref> |

| − | Of course the first expectation to make the customer segmentation possible is that the customer base is dividable. That is determined by the data, which are collected by the particular business, wanting to segment its customer base. The input keys are used to differentiate customers could be demographical (like age, gender, income), psychographic (lifestyle), geographic (geo location – where the customer lives) or behavioral (spending habits, product preferences). | + | Of course the first expectation to make the customer segmentation possible is that the customer base is dividable. That is determined by the data, which are collected by the particular business, wanting to segment its customer base. The input keys are used to differentiate customers could be demographical (like age, gender, income), psychographic (lifestyle), geographic (geo location – where the customer lives) or behavioral (spending habits, product preferences). <ref> Segment your customers [online]. [cit. 2016-01-24]. Available at: http://www.infoentrepreneurs.org/en/guides/segment-your-customers/ </ref> |

| − | |||

| − | |||

=Possible costumer segmentation techniques= | =Possible costumer segmentation techniques= | ||

There are many possible customer segmentation techniques, I will briefly explain some of the more common ones. The type of segmentation used will very on a lot of factors (goals, costs, etc.). | There are many possible customer segmentation techniques, I will briefly explain some of the more common ones. The type of segmentation used will very on a lot of factors (goals, costs, etc.). | ||

| + | |||

| + | [[File:segment.jpg]] | ||

| + | |||

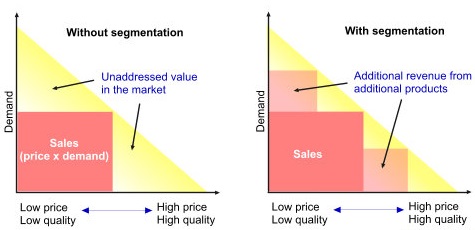

| + | Figure 1 - graphical illustration on how usage of customer segmentation effects business revenue due to development of additional products, which is only one of many possible outcomes. | ||

==A priory segmentation== | ==A priory segmentation== | ||

| − | This is one of the most simple approaches, where the market is divided according to already existing segments (that is why a priory – “pre-existing”) such as gender or age. In some businesses this approach of segmentation could be sufficient, for example the technology sector has a strong relationship between age and usage or product preferences. In other sectors it might be more difficult to segment the customer base using this method. Without any doubt sing this method is better than pure mass marketing, however it is still quite crude. | + | This is one of the most simple approaches, where the market is divided according to already existing segments (that is why a priory – “pre-existing”) such as gender or age. In some businesses this approach of segmentation could be sufficient, for example the technology sector has a strong relationship between age and usage or product preferences. In other sectors it might be more difficult to segment the customer base using this method. Without any doubt sing this method is better than pure mass marketing, however it is still quite crude. <ref> Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm </ref> |

| + | |||

| + | ==Usage segmentation== | ||

| + | |||

| + | Another rather simple approach of customer segmentation. There are two methods for usage segmentation either the customers are divided based on their weight of use or by time and place of usage. With the first method it is obvious that customers who buy more are more important to the business that the other ones. In here for example a “Pareto analysis” could be used to identify the top 20 % of most valuable customers. This method is normally used in business-to-business markets. The second method divides customers based on time and place. At different times customers may want different products available, so this method takes that into consideration. <ref> Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm </ref> | ||

==Needs based segmentation== | ==Needs based segmentation== | ||

| − | This approach mostly uses co called “Conjoint Analysis”, which is and advanced research technique (it also known as Discrete Choice Estimation). It gives the customer choices and then analysis why they made them. The output of such analysis is a measurement of utility. Firstly, with conjoint analysis a product or service is divided into its constituent parts. Than the possible combinations of these parts are tested to find which combinations are preferred by the customers. Furthermore each part may have multiple attributes (for example memory has a size and frequency). These attributes are defined in levels a computer memory can for example have 4 GB or 8 GB and operate on 1600 or 2133 MHz. Attributes and levels are used to define products and one of the first steps of conjoint analysis is to define a set of product profiles, which represent choices for customers. The number of possible product profiles rapidly increases with each additional attribute, therefor it is important to find balance between the number of attributes and complexity of customer choice, in order to get quality results. After this a range of statistical tools can be used to analyze which items customers choose or prefer from the product profiles. With need based segmentation the specific individual needs are identified and with the above approach they can be used to find other products, which meet the same customer requirements. Such products can then be offered to a particular customer by the seller. | + | This approach mostly uses co called “Conjoint Analysis”, which is and advanced research technique (it also known as Discrete Choice Estimation). It gives the customer choices and then analysis why they made them. The output of such analysis is a measurement of utility. Firstly, with conjoint analysis a product or service is divided into its constituent parts. Than the possible combinations of these parts are tested to find which combinations are preferred by the customers. Furthermore each part may have multiple attributes (for example memory has a size and frequency). These attributes are defined in levels a computer memory can for example have 4 GB or 8 GB and operate on 1600 or 2133 MHz. Attributes and levels are used to define products and one of the first steps of conjoint analysis is to define a set of product profiles, which represent choices for customers. The number of possible product profiles rapidly increases with each additional attribute, therefor it is important to find balance between the number of attributes and complexity of customer choice, in order to get quality results. After this a range of statistical tools can be used to analyze which items customers choose or prefer from the product profiles. With need based segmentation the specific individual needs are identified and with the above approach they can be used to find other products, which meet the same customer requirements. Such products can then be offered to a particular customer by the seller. <ref> Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm </ref> <ref> Conjoint analysis [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Conjoint/Conjoint_analysis.htm </ref> |

==Qualitative approach== | ==Qualitative approach== | ||

| − | An approach about why and what for are (in this case customers) behaving the way they are. Usually the outcome of this method is not enough to base a statistic on, it rather focuses on getting several different surveying. The aim is to get the best picture about the market and the customers so that one could spot the gaps, the similarities and the differences and exploit them. Focus groups or individual depth interviews are very often used to clarify the behavior and attitude of people. Sometimes it might be a good idea to use another technique such as conflict groups, triads or paired interviews. Outcome of these techniques is researcher (or a moderator) dependent, meaning he must be experienced in order to get the correct information out of the interview. It may happen that the participants may not be willing to speak their mind freely and will just repeat what they believe to be right. It is safe to say that a mind probe would make this approach a lot easier, unluckily this technology we do not possess. The discussion itself usually starts with a really broad term or subject and is later narrowed down by the moderator without putting too much pressure on the interviewed meanwhile getting an idea about how their beliefs and views of the subject changes throughout the session. The most valued facts about these participants are in the end their mood and their spontaneous reactions. Taking in count any information that is artificially created by the interviewees to cover up their true opinion is lowering the value of the session and of the finding itself. Though describing this technique defies its original purpose to be original every single time and it is contentious whether or not the results are valuable. | + | An approach about why and what for are (in this case customers) behaving the way they are. Usually the outcome of this method is not enough to base a statistic on, it rather focuses on getting several different surveying. The aim is to get the best picture about the market and the customers so that one could spot the gaps, the similarities and the differences and exploit them. Focus groups or individual depth interviews are very often used to clarify the behavior and attitude of people. Sometimes it might be a good idea to use another technique such as conflict groups, triads or paired interviews. Outcome of these techniques is researcher (or a moderator) dependent, meaning he must be experienced in order to get the correct information out of the interview. It may happen that the participants may not be willing to speak their mind freely and will just repeat what they believe to be right. It is safe to say that a mind probe would make this approach a lot easier, unluckily this technology we do not possess. The discussion itself usually starts with a really broad term or subject and is later narrowed down by the moderator without putting too much pressure on the interviewed meanwhile getting an idea about how their beliefs and views of the subject changes throughout the session. The most valued facts about these participants are in the end their mood and their spontaneous reactions. Taking in count any information that is artificially created by the interviewees to cover up their true opinion is lowering the value of the session and of the finding itself. Though describing this technique defies its original purpose to be original every single time and it is contentious whether or not the results are valuable. <ref> Qualitative research [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/qualitative_research.htm</ref> |

==Clustering approach== | ==Clustering approach== | ||

| Line 35: | Line 41: | ||

With ''partition clustering'' it is decided how many clusters will be (or better should be, because the result needn’t be possible) formed at the beginning. There are multiple methods of computation. One of the basic ones lies in specifying the “seed” observations for each one of the desired clusters. Than calculate the distance from each of the remaining observations to each seed and assign each observation to the nearest seed to form a set of clusters. This process can be repeated to reach greater homogeneity. | With ''partition clustering'' it is decided how many clusters will be (or better should be, because the result needn’t be possible) formed at the beginning. There are multiple methods of computation. One of the basic ones lies in specifying the “seed” observations for each one of the desired clusters. Than calculate the distance from each of the remaining observations to each seed and assign each observation to the nearest seed to form a set of clusters. This process can be repeated to reach greater homogeneity. | ||

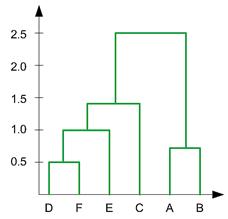

| − | ''Hierarchical clustering'' is the second common approach, is based on assumption that closer objects are more related than the further ones. The algorithm begins by finding a most similar pair of observations in terms of previously defined criteria and joins them to form a group. The next part is to find another pair, which can be again joined together or joined to a previously formed group if the distance is shorter. | + | ''Hierarchical clustering'' is the second common approach, is based on assumption that closer objects are more related than the further ones. The algorithm begins by finding a most similar pair of observations in terms of previously defined criteria and joins them to form a group. The next part is to find another pair, which can be again joined together or joined to a previously formed group if the distance is shorter. <ref>Approaches to Segmentation [online]. [cit. 2016-01-24]. Available at: http://www.marketingdecisions.net/Arts-Notes/Segmentation1.html</ref> |

| + | |||

| + | [[File:hi_cluster.jpg]] | ||

| − | + | Figure 2 - graphical example of hierarchical clustering <ref> Hierarchical clustering [online]. [cit. 2016-01-23]. Available at: http://people.revoledu.com/kardi/tutorial/Clustering/Numerical%20Example.htm </ref> | |

=Customer segmentation in SimProcess= | =Customer segmentation in SimProcess= | ||

| Line 44: | Line 52: | ||

[[File:cs_model.jpg]] | [[File:cs_model.jpg]] | ||

| + | |||

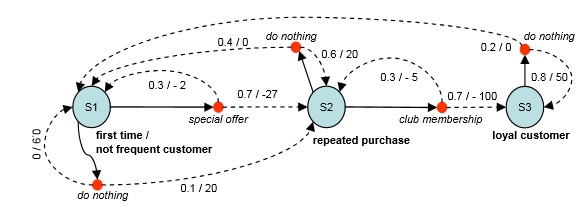

| + | Figure 3 - Possible model for SimProcess <ref>Allocation of Marketing Resources to Optimize Customer Equity [online]. [cit. 2016-01-23]. Available at: http://www1.unisg.ch/www/edis.nsf/SysLkpByIdentifier/3038/$FILE/dis3038.pdf</ref> | ||

This model could be used as a bases for possible design of a SimProcess simulation. Of course a generation of customers’ needs to be added. After that this could lead to finding out how many customers of different groups the business could have. | This model could be used as a bases for possible design of a SimProcess simulation. Of course a generation of customers’ needs to be added. After that this could lead to finding out how many customers of different groups the business could have. | ||

| + | Other than this it is easier to imagine the usage of customer segmentation in simulations. As the segmentation is already done and it is used only as input for the simulation. | ||

| + | |||

| + | =Simulator and simulation game= | ||

| + | This part of the article describes two cases of customer segmentation usage, where simulation is a factor. | ||

| + | |||

| + | ==Market Segmentation Simulator== | ||

| + | There is a conjoint simulator web application, which gives the ability to predict the market share of new products and to measure the gain or loss in market share based on changes to existing products. this application uses the Conjoint Analysis described before in this article. So the user needs to define the attributes and levels, which are then used to create product concepts (profiles) by the simulator application. The goal of the application is to simulate the market share of the products to establish a baseline. | ||

| + | |||

| + | ==Marketing Management Simulation Game== | ||

| + | This simulation game has some aspects of customer segmentation, so I find it worth mentioning in this article. It is developed by Cesim SimBrand and targets the marketing decision making process. It has 8 customer segments, 2 market areas and six different products. The game covers many others areas of marketing, than just customer segmentation, like: product life cycle management, positioning, after sales services, pricing, sales forecasting, competitor analysis and profitability. Its expected outcome is to help the participant to get a better understanding of the whole process. <ref> Marketing Management Simulation Game [online]. [cit. 2016-01-24]. Available at: http://www.cesim.com/simulations/cesim-simbrand-marketing-management-simulation-game </ref> | ||

=Summary= | =Summary= | ||

| Line 52: | Line 72: | ||

=Resources= | =Resources= | ||

| − | |||

| − | |||

Latest revision as of 23:11, 24 January 2016

- The Essay topic: Customer segmentation techniques (article)

- Class:4IT496 System Simulation (WS 2015/2016)

- Author: Bc. Patrik Tomášek (xtomp36)

Contents

Introduction

This article briefly describes the basics of customer segmentation, what it means and what its benefits are. Furthermore some of the most common techniques are also mentioned and described.

Customer segmentation in general

What is customer segmentation in general? It is a sort of practice which divides customers in smaller groups based on multiple characteristics and gives the business a better understanding of its customers, which has a great value in B2C relationship. Some of the other benefits could be identification of least profitable customer group, improvement of customer service, data for making marketing decisions (which group to target) or avoiding unprofitable markets. The main goal of this whole process should be to maximize the value of each single customer. There could be other goals of customer segmentation, however it rather depends on the particular business and its preferences. Examples of common segmentation objectives include development of new product, differentiated customer servicing or targeting prospects with the highest profit potential. [1]

Of course the first expectation to make the customer segmentation possible is that the customer base is dividable. That is determined by the data, which are collected by the particular business, wanting to segment its customer base. The input keys are used to differentiate customers could be demographical (like age, gender, income), psychographic (lifestyle), geographic (geo location – where the customer lives) or behavioral (spending habits, product preferences). [2]

Possible costumer segmentation techniques

There are many possible customer segmentation techniques, I will briefly explain some of the more common ones. The type of segmentation used will very on a lot of factors (goals, costs, etc.).

Figure 1 - graphical illustration on how usage of customer segmentation effects business revenue due to development of additional products, which is only one of many possible outcomes.

A priory segmentation

This is one of the most simple approaches, where the market is divided according to already existing segments (that is why a priory – “pre-existing”) such as gender or age. In some businesses this approach of segmentation could be sufficient, for example the technology sector has a strong relationship between age and usage or product preferences. In other sectors it might be more difficult to segment the customer base using this method. Without any doubt sing this method is better than pure mass marketing, however it is still quite crude. [3]

Usage segmentation

Another rather simple approach of customer segmentation. There are two methods for usage segmentation either the customers are divided based on their weight of use or by time and place of usage. With the first method it is obvious that customers who buy more are more important to the business that the other ones. In here for example a “Pareto analysis” could be used to identify the top 20 % of most valuable customers. This method is normally used in business-to-business markets. The second method divides customers based on time and place. At different times customers may want different products available, so this method takes that into consideration. [4]

Needs based segmentation

This approach mostly uses co called “Conjoint Analysis”, which is and advanced research technique (it also known as Discrete Choice Estimation). It gives the customer choices and then analysis why they made them. The output of such analysis is a measurement of utility. Firstly, with conjoint analysis a product or service is divided into its constituent parts. Than the possible combinations of these parts are tested to find which combinations are preferred by the customers. Furthermore each part may have multiple attributes (for example memory has a size and frequency). These attributes are defined in levels a computer memory can for example have 4 GB or 8 GB and operate on 1600 or 2133 MHz. Attributes and levels are used to define products and one of the first steps of conjoint analysis is to define a set of product profiles, which represent choices for customers. The number of possible product profiles rapidly increases with each additional attribute, therefor it is important to find balance between the number of attributes and complexity of customer choice, in order to get quality results. After this a range of statistical tools can be used to analyze which items customers choose or prefer from the product profiles. With need based segmentation the specific individual needs are identified and with the above approach they can be used to find other products, which meet the same customer requirements. Such products can then be offered to a particular customer by the seller. [5] [6]

Qualitative approach

An approach about why and what for are (in this case customers) behaving the way they are. Usually the outcome of this method is not enough to base a statistic on, it rather focuses on getting several different surveying. The aim is to get the best picture about the market and the customers so that one could spot the gaps, the similarities and the differences and exploit them. Focus groups or individual depth interviews are very often used to clarify the behavior and attitude of people. Sometimes it might be a good idea to use another technique such as conflict groups, triads or paired interviews. Outcome of these techniques is researcher (or a moderator) dependent, meaning he must be experienced in order to get the correct information out of the interview. It may happen that the participants may not be willing to speak their mind freely and will just repeat what they believe to be right. It is safe to say that a mind probe would make this approach a lot easier, unluckily this technology we do not possess. The discussion itself usually starts with a really broad term or subject and is later narrowed down by the moderator without putting too much pressure on the interviewed meanwhile getting an idea about how their beliefs and views of the subject changes throughout the session. The most valued facts about these participants are in the end their mood and their spontaneous reactions. Taking in count any information that is artificially created by the interviewees to cover up their true opinion is lowering the value of the session and of the finding itself. Though describing this technique defies its original purpose to be original every single time and it is contentious whether or not the results are valuable. [7]

Clustering approach

This is one of the more advanced approaches, because it can be used to split customers based on the way they think or feel, rather than only who they are. This method start with individuals and forms segments with them based on similarities. At first it is necessary to choose one or more criteria, which will be used to assess the similarity between individuals (as already states it is common to use behavioral data with clustering). A good way to search for input data might be in surveys, which often focus on customer attitude with the business or product. If multiple criteria are in place, it might be necessary to standardize them so that they have comparable weight. Secondly it is important to choose clustering approach that will be used. There are two commonly applied approaches to clustering, partition clustering and hierarchical clustering.

With partition clustering it is decided how many clusters will be (or better should be, because the result needn’t be possible) formed at the beginning. There are multiple methods of computation. One of the basic ones lies in specifying the “seed” observations for each one of the desired clusters. Than calculate the distance from each of the remaining observations to each seed and assign each observation to the nearest seed to form a set of clusters. This process can be repeated to reach greater homogeneity.

Hierarchical clustering is the second common approach, is based on assumption that closer objects are more related than the further ones. The algorithm begins by finding a most similar pair of observations in terms of previously defined criteria and joins them to form a group. The next part is to find another pair, which can be again joined together or joined to a previously formed group if the distance is shorter. [8]

Figure 2 - graphical example of hierarchical clustering [9]

Customer segmentation in SimProcess

It is rather hard to imagine the usage of customer segmentation in a program like SimProcess or Netlogo. However in SimProcess it might be possible to model the customer behavior and segment them based on predefined actions.

Figure 3 - Possible model for SimProcess [10]

This model could be used as a bases for possible design of a SimProcess simulation. Of course a generation of customers’ needs to be added. After that this could lead to finding out how many customers of different groups the business could have. Other than this it is easier to imagine the usage of customer segmentation in simulations. As the segmentation is already done and it is used only as input for the simulation.

Simulator and simulation game

This part of the article describes two cases of customer segmentation usage, where simulation is a factor.

Market Segmentation Simulator

There is a conjoint simulator web application, which gives the ability to predict the market share of new products and to measure the gain or loss in market share based on changes to existing products. this application uses the Conjoint Analysis described before in this article. So the user needs to define the attributes and levels, which are then used to create product concepts (profiles) by the simulator application. The goal of the application is to simulate the market share of the products to establish a baseline.

Marketing Management Simulation Game

This simulation game has some aspects of customer segmentation, so I find it worth mentioning in this article. It is developed by Cesim SimBrand and targets the marketing decision making process. It has 8 customer segments, 2 market areas and six different products. The game covers many others areas of marketing, than just customer segmentation, like: product life cycle management, positioning, after sales services, pricing, sales forecasting, competitor analysis and profitability. Its expected outcome is to help the participant to get a better understanding of the whole process. [11]

Summary

This article has introduced to the reader the topic of customer segmentation, its basics, usage and some of the possible techniques, which are used to segment customers. It is clear that most of the segmentation techniques aren’t simple and are impossible without proper solution, however the business value is undeniable. Of course the technique used for segmentation will depend on the business needs.

Resources

- ↑ Customer segmentation definition [online]. [cit. 2016-01-24]. Available at: http://searchsalesforce.techtarget.com/definition/customer-segmentation

- ↑ Segment your customers [online]. [cit. 2016-01-24]. Available at: http://www.infoentrepreneurs.org/en/guides/segment-your-customers/

- ↑ Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm

- ↑ Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm

- ↑ Market segmentation [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/segmentation.htm

- ↑ Conjoint analysis [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Conjoint/Conjoint_analysis.htm

- ↑ Qualitative research [online]. [cit. 2016-01-23]. Available at: http://www.dobney.com/Research/qualitative_research.htm

- ↑ Approaches to Segmentation [online]. [cit. 2016-01-24]. Available at: http://www.marketingdecisions.net/Arts-Notes/Segmentation1.html

- ↑ Hierarchical clustering [online]. [cit. 2016-01-23]. Available at: http://people.revoledu.com/kardi/tutorial/Clustering/Numerical%20Example.htm

- ↑ Allocation of Marketing Resources to Optimize Customer Equity [online]. [cit. 2016-01-23]. Available at: http://www1.unisg.ch/www/edis.nsf/SysLkpByIdentifier/3038/$FILE/dis3038.pdf

- ↑ Marketing Management Simulation Game [online]. [cit. 2016-01-24]. Available at: http://www.cesim.com/simulations/cesim-simbrand-marketing-management-simulation-game