Difference between revisions of "Default"

(→Model) |

|||

| Line 110: | Line 110: | ||

* Paper (1000 - consumable) - '''3 papers''' per customer on average | * Paper (1000 - consumable) - '''3 papers''' per customer on average | ||

* Token and flash drive (1000 - consumable) - 1 per customer on average | * Token and flash drive (1000 - consumable) - 1 per customer on average | ||

| − | Improved model does not contain any major changes in structure. Process steps remain the same with one exception - Stapling documents step is removed. What changes is ''time of process steps''. So process flow is the same as on picture above, however improved "Contracts" process step contains only two sub-processes: | + | Improved model does not contain any major changes in structure. Process steps remain the same with one exception - Stapling documents step is removed. What changes is ''time of process steps'' and ''resources consumption''. So process flow is the same as on picture above, however improved "Contracts" process step contains only two sub-processes: |

[[File:Improved_process.png]] | [[File:Improved_process.png]] | ||

Revision as of 19:16, 12 January 2014

- Project name: Account opening process optimization

- Class: 4IT496 Simulation of Systems (WS 2013/2014)

- Author: Yulia Zinchenko

- Model type: Descrete-event simulation

- Software used: SimProcess

Contents

Introduction

Simulation is based on real data gained in terms of the project aimed to optimize the process of account opening at branches of one of the Czech banks. This bank is rather small and new to Czech market. Its market share is around 1%. Currently this bank has 23 branches in the country, which are open Monday to Friday 9:00 - 18:00. There are 3 sales managers on average at each branch. They serve new-to-bank customers as well as already existing customers. Bank does not have innovative information systems and does not plan to make major investments in it in the nearest future. According to customers` feedback its competetive advantage is very personal attitude to each client providing them with high-quality service meeting their personal needs.

Methodology

In real-life this project is managed by using Lean Six Sigma methodology, which is a blend of Lean management and Six Sigma. It has Six Sigma DMAIC project lifecycle and Lean types of waste to eliminate. Six Sigma project lifecycle consists of 5 phases:

- Define

- Measure

- Analyze

- Improve

- Control

Process simulation that is further described is a part of Analyze phase, when there already are objective data and possible areas of improvement need to be identified, solution is analyzed and tested. First As-Is model is created in order to get an overview of the existing situation and after the areas of improvement are identified, To-Be model is created in order to test if the improvement will help to meet the target.

As-Is Process Description

That project was initiated by feedback from account officers working at the branches, who stated that it takes around 45 minutes on average to open a current account package for customer, however sometimes it may take up to 90 minutes (for example in case customer wants to have current accounts in a few currencies). Current account package includes:

- Current account in currency CZK, EUR or USD

- Payment card Visa or MasterCard

- Online Banking

- Savings account (optional)

As-is process steps:

- Customer Arrival - 2 new-to-bank customers wishing to open a current account package per hour (at every branch).

- Identification of clients` needs (cross-selling). Available sales manager meets the customer and identifies his/her needs using a "Sales map", which is an opportunity to cross-sell other products and services. This procedure takes 5 minutes on avergae, however time varies significantly. Some customers come just to arrange a concrete product and don`t have time for extra talking, on the other hand other customers are pleased to discuss their financial situation with a sales manager and look at the benefits of other products. So this process step may take from 30 seconds up to 15 minutes.

- Identification. Sales manager asks for identification documents, performs online check of the person and makes a copy of the ID. Every potential customer needs to be checked in a few online sources, which takes some time. Together with making a copy of the ID this step takes 5 minutes on average.

- Entering data into information systems. Sales manager enters client`s personal data into information system and creates new account package accordingly. Unfortunately there are a few information systems and applications, where data need to be entered. So account type, payment card type and online banking settings are set on three separate places. That is time-consuming, however new IT solution is out of scope, so the project does not focus on this issue. Entering data into systems takes 12 minutes on average, however there may be some extreme situations when systems` response time is longer, so this procedure may take up to 30 minutes.

- Printing and signing of contracts. Sales manager prints the contracts, staples them and signs together with the customer. Because of the fact that there are several information systems, contracts are printed separately from each of them (depending on the product). Each contract consists of 2,5 pages on average and all the documentation has 22 pages per every current account package on average (in case client does not have any disponent). Because of so many pages of documentation it becomes very difficult and time-consuming to bring it all together, separate and staple it and sign together with the customer explaining the meaning of each paragraph. This procedure takes 17 minutes on average.

- Give a folder with documentation to client. Sales manager prepares a folder with all the documents, online banking access key (token), flash drive with terms and conditions, infocard and gives it to client. This procedure takes up to 9 minutes on average. And the most time-consuming part is manually filling in a paper card with an account number (especially when a client opens several accounts at once - in this case sales manager needs to fill in several cards).

- Client leaves the bank.

Total time is 48 minutes on average. However it may take much longer in case customer would like to have accounts in several currencies with more than one payment card.

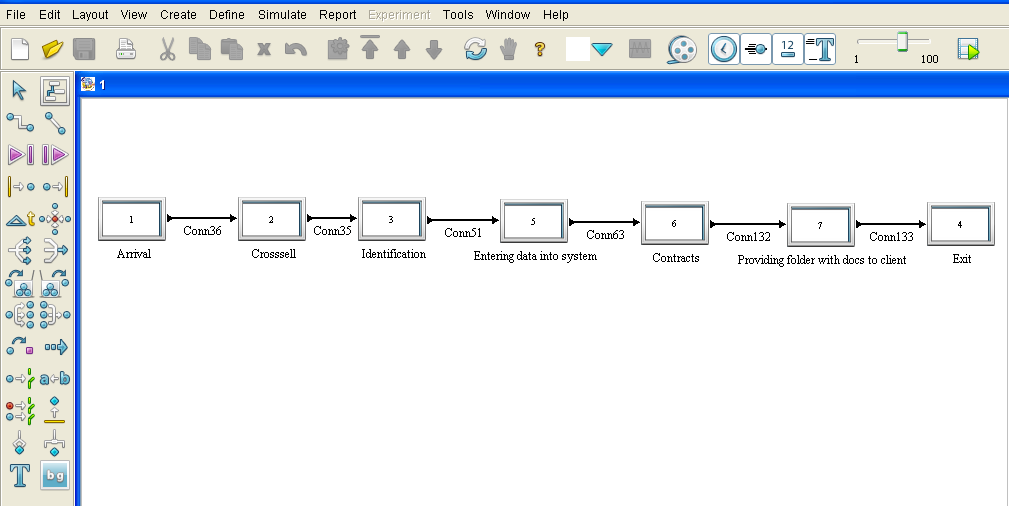

Model

Entity

- Customer (2 per hour)

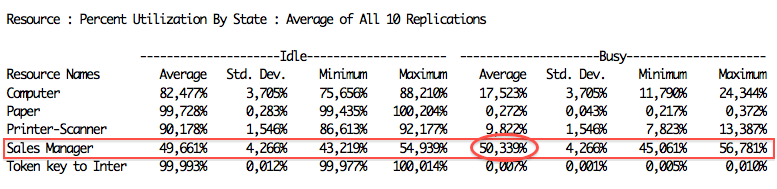

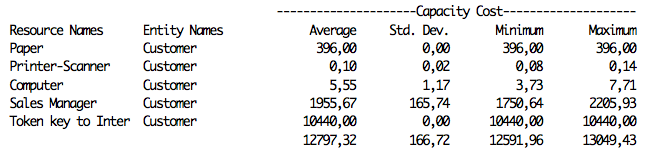

Resources

- Sales manager (3)

- Computer (3)

- Printer/scanner (1)

- Paper (1000 - consumable) - 22 papers per customer on average

- Token and flash drive (1000 - consumable) - 1 per customer on average

Process Overview

Problem statement

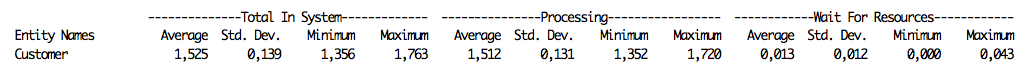

Workload of each sales manager should be as follows:

- 35% of time spent for serving of new-to-bank customers (this process)

- 40% of time spent for serving existing customer

- 10% of time spent on post-processing of documentation after client leaves the branch

- 15% of time spent on emails, calls and other ad-hoc requests

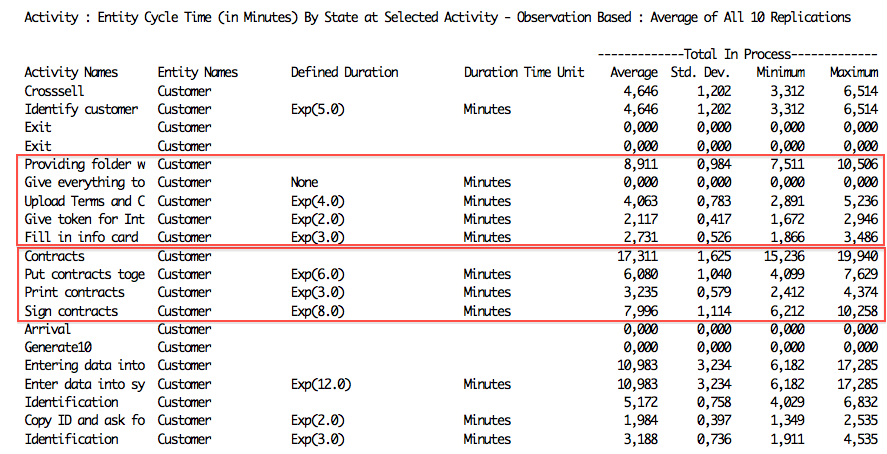

From the simulation report it is evident that currently sales manager spends around 50% of time serving new-to-bank customers. Another issue is printing costs - 22 papers printed both sided is too much per each current account package. Not only it increases the costs, it also increases time of the "Contracts" process step. The more paper is, the more "motion" with it is required, which is time-consuming. However good news is that there is almost no waiting time, which has also been an object of customers` positive feedback.

Process steps to improve

The most problematic areas that need to be improved are:

- "Contracts"

- Printing (3 minutes) - contract for each account + payment card + online banking + concents

- Stapling (6 minutes) - printed papers need to be put together, stapled and sticker on top left corner is attached

- Signing (8 minutes) - 2 signatures of sales managers (4 eyes check) + 1 customer`s signature per each contract

- "Prepare and give folder to client"

- Explanation how to log in to online banking for the first time (2 minutes) - can take more with older clients

- Filling in info cards with account number (3 minutes) - one per each account; very time-consuming in case client opens several accounts at once

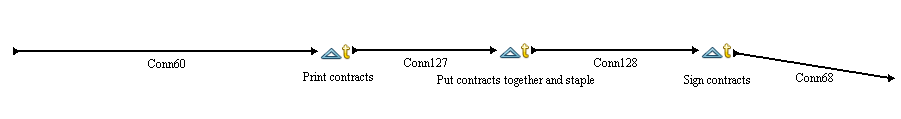

Step "Contracts" sub-processes

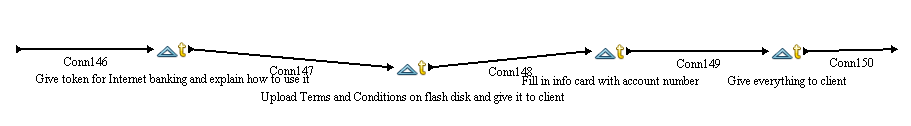

Step "Providing folder with docs to client" sub-processes

To-Be Process Description

Solutions

Solution focuses on process steps described in previous paragraphs.

- "Contracts"

- Printing - unified all-in-one contract (2 documents printed both sided)

- Stapling - nothing to staple; can to be removed

- Signing - 1 signature of sales manager + 1 customer`s signature per each contract

- " Prepare and give folder to client"

- Explanation how to log in to online banking for the first time - ask a client if he wants an advise (step becomes optional)

- Filling in info cards with account number - info card redesign; one for up to 4 accounts

Time reduction (on average):

- "Contracts"

- Printing : 3 minutes => 0,5 minutes

- Stapling : 6 minutes => 0 minutes (removed)

- Signing : 8 minutes => 2 minutes

- " Prepare and give folder to client"

- Explanation how to log in to online banking for the first time : 2 minutes => 0,5 minutes

- Filling in info cards with account number : 3 minutes => 0,5 minutes

Resources consumption improvement (on average):

- Paper consumption : 22 per account package => 3 per account package

Model

Entity

- Customer (2 per hour)

Resources

- Sales manager (3)

- Computer (3)

- Printer/scanner (1)

- Paper (1000 - consumable) - 3 papers per customer on average

- Token and flash drive (1000 - consumable) - 1 per customer on average

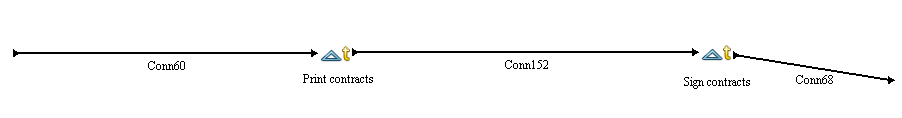

Improved model does not contain any major changes in structure. Process steps remain the same with one exception - Stapling documents step is removed. What changes is time of process steps and resources consumption. So process flow is the same as on picture above, however improved "Contracts" process step contains only two sub-processes:

Conclusion

From the simulation report of the improved process it is evident that target is met - sales managers spend up to 30% of time serving new-to-bank customers. It is achieved mainly because of documentation unification as well as info cards redesign and correction of other process steps. That also has a positive impact on paper consumption as well as printing costs, which significantly decreased.